Summary

While the number of vehicles sold in Q3 increased, YoY revenues actually fell 12%, gross profit fell 22% and EPS fell 56%.

TSLA “adjusts” net income and EPS in “interesting” ways that do not reflect the true sustainable profitability of the company.

Reported cash flows include a significant share-based compensation component that is greater than the GAAP profit.

The company borrows money not only from its customers but also from its existing shareholders.

If you exclude regulatory credits of $134M, in Q3 the company made virtually no money.

I have solar panels and drove over 15K miles in last 12 months on electricity, most of it using adaptive cruise control. I am bullish on electric vehicles and self-driving. With that out of the way, I will explain to you why I am bearish on Tesla (TSLA) and how Elon Musk runs the company on money borrowed not only via debt, but also from its customers and even from its existing shareholders, while making virtually no money in the process.

Some Background

Tesla bulls base their thesis on equating electric vehicles, solar power and self-driving to Tesla. They project significant growth in those areas for Tesla as if they assume that competitors will merely concede the market to Tesla. Further, they assume Tesla has a technological lead in all of those areas. This is simply not the case. For a long time, Tesla and Solar City relied on Panasonic for solar panel and battery technology. I personally have a SunPower solar system, because it has a higher efficiency coefficient. While Panasonic panels are not far behind, they are also available from independent installers for a lower installed cost.

As for self-driving, GM and Google have the lead at this point. Finally, on the electric vehicle front, there will be an onslaught of competition from established players, especially starting in 2020, due to regulatory changes in Europe. For people like me, who won’t accept shoddy quality and cost-cutting masquerading as modern design, EVs from established players will fit the bill nicely.

To give Tesla and Musk credit, they have excellent electric motor tech, groundbreaking over the air software updates, the “coolness” factor, low advertising costs via random Tweets, can borrow money from its customers and existing shareholders. Unfortunately, the latter is something that helped build the company yet distorts the financial numbers that some people accept at face value. Let’s look at those numbers, in particular at the Q3 results that for some reason people see as positive.

Q3 Numbers

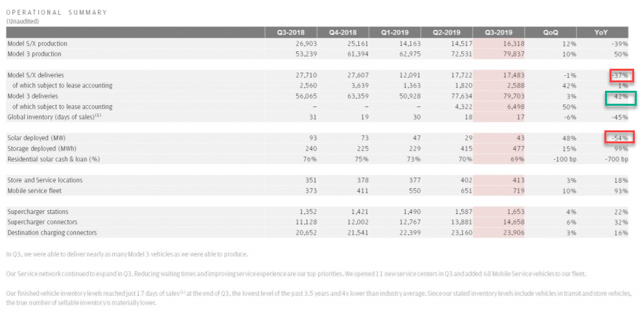

While we wait for the Form 10-Q to be filed, we have the TSLA Form 8-K to get the numbers from. We need to compare numbers YoY, to the Q3 2018 since there is seasonality to sales. Below you can see that sales of more lucrative models S and X are falling while Model 3 increased. Solar installs are falling too.

Source: TLSA Form 8-K

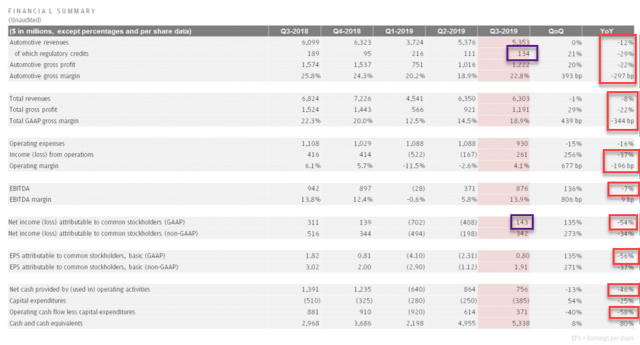

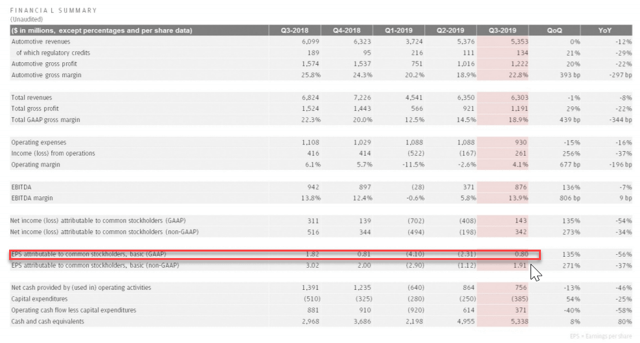

If we look at financials, the picture is troubling. Sales, margins and profits are all down significantly YoY. The only consolation is the numbers are better than the horrible Q1 and mediocre Q2. Also note, almost the entirety of net income is made by regulatory credits. In other words, without them the company made virtually no money.

Source: TLSA Form 8-K

In fact, this is the story of Tesla business model so far. Regulatory credits that contribute to both top and bottom lines as well as tax incentives that encourage people to pay more for Tesla’s products, since they will be getting some of the money back via tax credits. Now that the latter is being scaled down, Tesla has to absorb the difference.

Invisible Borrowing

While it is widely known that Tesla issued bonds, what is less understood is that they borrowed money from their own customers and event existing shareholders. The borrowing from customers is relatively straightforward: you can pay for vaguely-defined functionality that will be delivered later (if at all). The borrowing from existing shareholder is less obvious and is being spun as a positive by Tesla adding it back into its “Adjusted EPS” as well as into FCF.

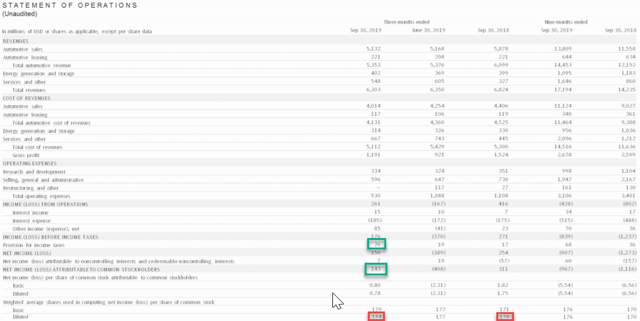

In one of his speeches, published in “Poor Charlie’s Almanac”, Charlie Munger presented a hypothetical company that switched some of their employee compensation from cash to stock. Share-based compensation is not free, especially if it is as impactful as at Tesla. In Q3, the SBC was $199M. For comparison, it was more than the net profit of the company. It is obvious that SBC is not “free”, it dilutes existing shareholders. In other words, it is logically no different than if Tesla issued additional shares, sold them and then used the proceeds for the actual cash compensation, in-kind. You can see the dilution, some of which is due to SBC:

Source: TLSA Form 8-K

You can see the dilution in the areas I highlighted. About 4% a year might not sound like much, but it adds up over time. Holding the same number of shares, over time you own smaller and smaller part of the company. Yet TSLA takes that money that they effectively borrowing from their own existing shareholders and pretend it was “free” while calculating “Adjusted EPS”.

Adjusted Net Income and EPS

While the Q3 GAAP net profit was $143M and diluted EPS was $0.78, the “adjusted net income” was provided as $342M and “adjusted EPS” was given as $1.91. This is just pure fiction. Usually, when companies provide “adjusted” net income and EPS, they exclude non-recurring items that do not reflect the true profitability of the company. They take GAAP numbers, then remove restructuring or similar costs, after tax. I have never seen companies add back SBC, until now.

As I demonstrated above, SBC has a real cost. If Tesla actually issued stock, sold it, and then used the proceeds to compensate its people instead of SBC, it would have to pay actual money. Assuming that money is $199M, the Q3 “adjusted” net income and EPS should be the same as GAAP numbers.

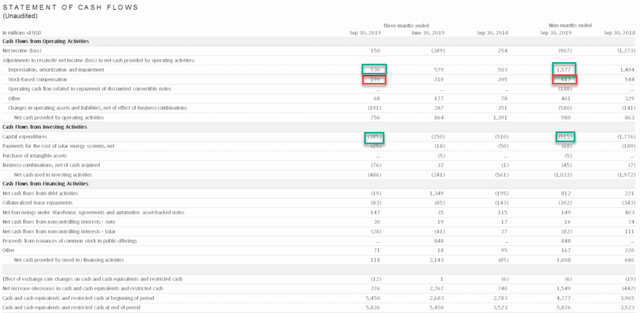

Free Cash Flow

Similarly to the “adjusted” net income and EPS, FCF has SBC added back, which is correct since SBC was not nominally a cash cost. However, because the SBC at Tesla is so large in relation to FCF, it negates the benefit their FCF exhibits from the significant difference between the D&A and CapEx. For the 9 months, the D&A approximately matches CapEx plus SBC. SBC serves as a financial activity of borrowing from the existing shareholders.

Source: TLSA Form 8-K

CapEx

To be fair, Tesla’s CapEx includes a “growth” component and therefore the sustaining, or “maintenance” CapEx is likely lower. However, car manufacturers are generally CapEx-heavy. Still, the Tesla’s “normalized” FCF would be greater than GAAP net income, even if you take SBC into account. Therefore Tesla is indeed more profitable than what GAAP net income and EPS imply. The question is by how much and to what extent will this headwind is being compensated by regulatory credits, that are also large.

Historical Performance

Let's not forget that the company keeps losing money on TTM or FY basis. See the highlighted area below.

Source: TLSA Form 8-K

The FCF if you adjust it for SBC is sharply negative as well. For trailing 9 months it would have been 980-915-617= negative $552M.

The numbers only look decent if you ignore SBC. In effect, existing shareholders give money to the company (via dilution) and then are positively surprised when that money appears in "adjusted EPS" and FCF numbers.

Bottom Line

Musk is a genius and Tesla has been a disruptor in many areas. In the current state, despite impressive “adjusted” numbers, in reality Tesla barely makes money. While I hope Tesla continues to be successful in contributing to electric vehicle and solar sales, I believe the current share prices are not justified by reasonable expectations. It remains to be seen if Tesla can achieve “escape velocity” at all, especially if there is a recession in near term. I am presently neither long nor short, but it will be interesting how the picture develops in 2020 when there is more competition and Tesla Model Y is released.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a short position in TSLA over the next 72 hours.